Research Report: Ardent Leisure Group Ltd (2020, Buy)

Basic Information

Ticker symbol: ALG

Primary exchange: Australian Stock Exchange (ASX)

Primary sector: Consumer cyclical

Industry: Amusement Parks

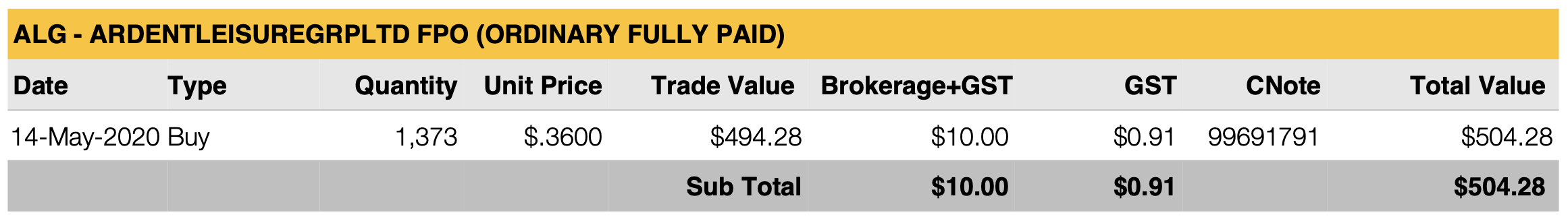

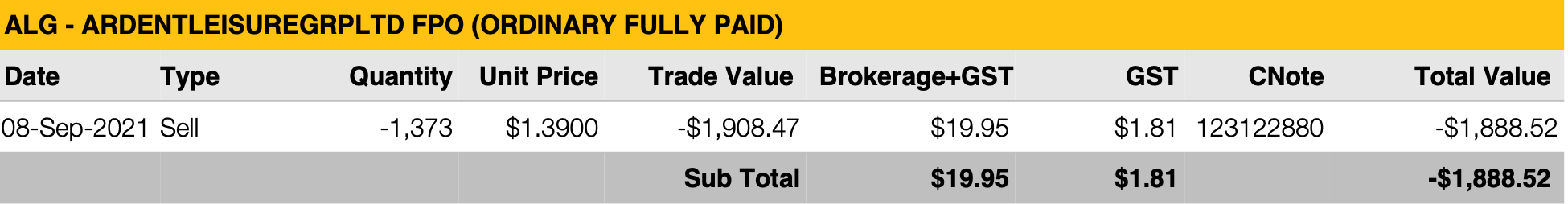

Investment recommendation (14 May, 2020): Buy

Current stock price (May 14, 2020): $0.3600

Market capitalization (May 14, 2020): ($0.3600 unit price x 479,706,016 shares outstanding, Source: 2020 ALG annual report ) = $172,694,166

Liquidity (Source: Market Index): 11 May 2020 - 15 May 2020: Volume 20,678,969. High liquidity.

Float (Source: 2009 ALG annual report): 303,981,829

Major shareholders (Source: 2020 ALG annual report): JP Morgan Nominees Australia Pty Limited 15.21%, Sumitomo Mitsui Trust Holdings Inc 13.59%, and HSBC Custody Nominees (Australia) Limited 12.92%.

Business Description

Ardent Leisure Group Limited owns and operates leisure and entertainment assets in Australia and the United States. The company operates in Main Event and Theme Parks segments. It operates 44 main event sites in Texas, Arizona, Georgia, Illinois, Kentucky, Missouri, New Mexico, Ohio, Oklahoma, Kansas, Florida, Tennessee, Maryland, Delaware, Colorado, and Louisiana, as well as Dreamworld and WhiteWater World in Coomera, Queensland; and the SkyPoint observation deck and climb in Surfers Paradise, Queensland. The company was incorporated in 2018 and is based in North Sydney, Australia.

Main drivers of revenues are from operating activities of amusement parks and event centres of $398,315,000 (accounts for 97% of total income).

Main drivers of expenses are salary and employee benefits of $179,816,000 (accounts for 33% of total expenses).

Industry Overview and Competitive Positioning

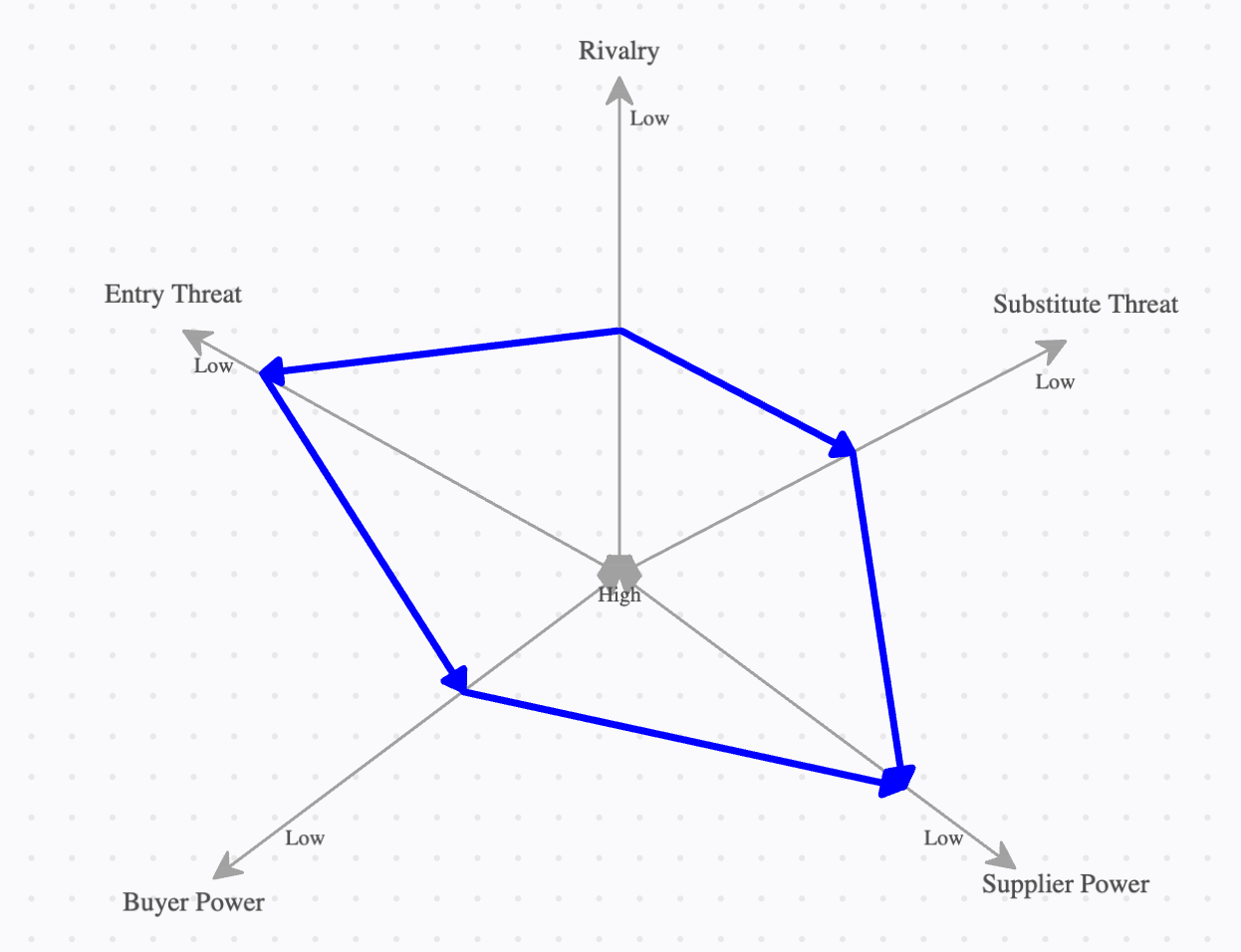

Rivalry among existing competitors = 3/5

Substitute threat = 3/5

Supplier Power = 2/5

Buyer Power = 3/5

Entry threat = 1/5

Based on the framework, the Amusement Parks industry is have moderate industry forces - moderate profit margins for Ardent Leisure

Investment Summary

Brief discussion: Ardent Leisure currently owns two famous Australian Theme Parks which are Dreamworld theme park and the WhiteWater World water park in Gold Coast, Queensland.

Significant recent developments: N/A, due to Covid-19 lockdowns.

Earnings forecast: Forecasted that earnings would revert back to the mean, once Covid-19 lockdowns were lifted.

Valuation summary: N/A, did not use any financial modelling.

Recommended investment action: I have chosen to buy Ardent Leisure, as it was deeply discounted. This is because theme park operations were shut down due to Covid-19 lockdowns back in 2020. This led to a dramatic decrease to operating cash flows and net income, as their main sources of revenue was cut. But, this was only a temporary problem and assumed that lockdowns would be lifted in a year time. After lockdown would be lifted customers flows will revert back to the mean, therefore profits and share price would follow.

Financial analysis:

Did not use any financial analysis nor financial models, as I assumed that Ardent Leisure is a cyclical stock and share price would follow the economic climate/business cycle, which at the time was bad due to lockdowns.

Investment risks:

Government regulation risks which was the Covid-lockdown policies being placed during 2020, specifically domestic state lockdowns, as customers were not allowed to travel to different states by air travel.

Covid-19 risks, as the strain could have potential mutations and spread to more people, slowing down the lift of Covid-19.

Environmental, social, and governance (ESG):

N/A